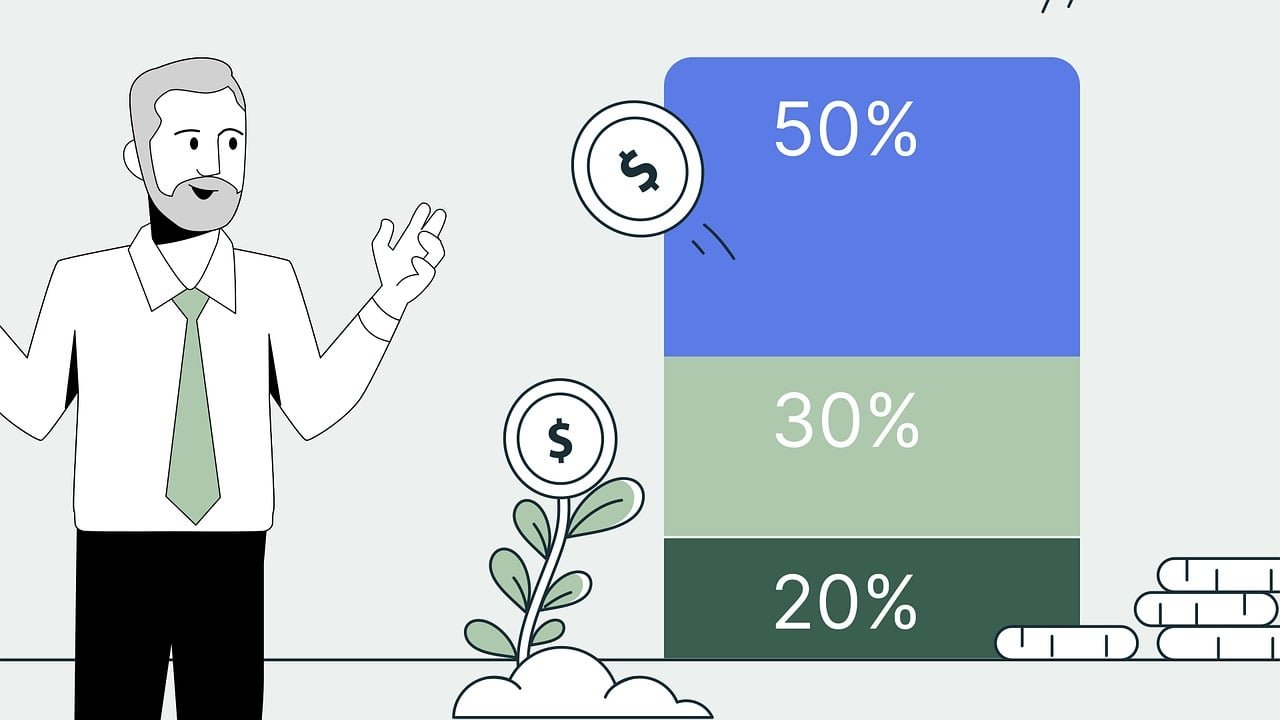

The 50/30/20 budget rule explained with examples is a simple and effective method for managing your finances. It helps individuals allocate their income in a way that covers essential expenses, allows for discretionary spending, and promotes savings. By dividing after-tax income into three categories—50% for needs, 30% for wants, and 20% for savings and debt repayment—this budgeting strategy provides a clear roadmap for maintaining financial balance. This approach not only aids in managing day-to-day expenses but also lays the foundation for long-term economic well-being.

The 50/30/20 rule breaks down as follows: 50% of your income should go toward essential needs like housing, utilities, and groceries. 30% is designated for wants, such as entertainment, dining out, and other non-essential luxuries. The remaining 20% is dedicated to savings and debt repayment, ensuring you are actively building a financial cushion and reducing outstanding obligations.

Adopting the 50/30/20 rule makes it easier to stay organized, track spending, and meet financial goals. This system encourages mindful spending while supporting long-term objectives like saving for retirement or paying off debts. By following this rule, individuals can achieve economic stability, minimize stress, and avoid overspending, creating a balanced approach to managing money.

Breakdown of the 50/30/20 Budget Rule Explained with Examples

The 50/30/20 budget rule explained with examples provides a straightforward and effective way to manage your finances by dividing your after-tax income into three key categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. The “needs” category includes essential expenses such as housing, utilities, and groceries. “Wants” refer to discretionary spending on items like dining out, entertainment, and other non-essential luxuries. The final 20% is allocated to savings and debt repayment, which helps you build financial security while managing your debts effectively.

This simple yet powerful budgeting strategy aims to provide clarity and balance in your financial management. It offers flexibility to adjust the allocations based on personal circumstances, ensuring that basic needs are met while allowing for enjoyable spending and future savings. The 50/30/20 rule is a great tool for achieving a balanced approach to budgeting that supports long-term financial health and encourages responsible money management.

Categories of the 50/30/20 Budget Rule Explained with Examples

The 50/30/20 budget rule explained with examples divides your finances into three key categories: needs, wants, and savings/debt repayment. The “50% Needs” category includes essential living expenses that are necessary for survival and well-being. These are fixed costs that cannot be easily adjusted. Common examples include rent or mortgage payments, utilities (electricity, water), groceries, transportation (gas, car payment), healthcare premiums, and essential insurance. To effectively manage this category, ensure these costs do not exceed 50% of your after-tax income. If they do, consider finding ways to lower your living expenses or adjust other parts of your budget.

The “30% Wants” category encompasses non-essential expenses that enhance your lifestyle but are more flexible and can be adjusted or eliminated if needed. These include discretionary spending like dining out, entertainment, vacations, hobbies, and luxury items such as designer clothes or the latest gadgets. To stay within this 30% limit, track your spending and adjust accordingly, ensuring it aligns with your overall financial situation and goals.

The “20% Savings and Debt Repayment” category focuses on securing your financial future. This portion is dedicated to building your emergency fund, contributing to retirement accounts, and repaying debts such as credit cards, student loans, or personal loans. Prioritize saving for future goals and paying off high-interest debt to build long-term financial stability. Adjust your savings and debt repayment contributions based on your financial goals and outstanding debt to ensure this category stays on track.

Practical Examples

Example 1: Single Person’s Budget

For a single person with an after-tax monthly income of $3,000, the 50/30/20 rule provides a structured way to allocate funds. According to this rule, 50% of the income, or $1,500, should be dedicated to needs. This includes $1,000 for rent, $150 for utilities, $200 for groceries, and $150 for transportation. The 30% allocated for wants, amounting to $900, covers expenses such as $200 for dining out, $150 for entertainment, $200 for travel, $100 for hobbies, and $250 for luxury items. Lastly, 20% of the income, or $600, is reserved for savings and debt repayment, with $300 going into an emergency fund, $200 towards retirement savings, and $100 allocated for credit card repayment.

Example 2: Family Budget

In the case of a family with an after-tax monthly income of $6,000, the 50/30/20 rule helps in organizing their finances effectively. Here, 50% of the income, which equals $3,000, is allocated to needs. This includes $2,000 for the mortgage, $300 for utilities, $500 for groceries, and $200 for transportation. The 30% portion for wants amounts to $1,800, which covers $300 for dining out, $250 for entertainment, $500 for travel, $200 for hobbies, and $550 for luxury items. The remaining 20%, or $1,200, is set aside for savings and debt repayment, including $600 for an emergency fund, $400 for retirement savings, and $200 for student loan repayment.

Example 3: High-Income Earner’s Budget

For a high-income earner with an after-tax monthly income of $10,000, the 50/30/20 rule ensures a balanced financial approach. The guideline states that necessities account for $5,000, or 50% of income. This pays for $500 in utilities, $800 in groceries, $3,000 towards the mortgage, and $700 towards transportation. The 30% allocated for wants, totalling $3,000, includes $500 for dining out, $500 for entertainment, $1,000 for travel, $500 for hobbies, and $500 for luxury items. The 20% for savings and debt repayment, amounting to $2,000, is divided into $800 for an emergency fund, $800 for retirement savings, and $400 for debt repayment.

Tips for Implementing the 50/30/20 Rule

To effectively implement the 50/30/20 rule, start by consistently tracking your expenses to ensure you adhere to the recommended allocations. Regular monitoring is crucial for staying within your budgetary limits and making informed financial decisions. Utilize budgeting apps or spreadsheets to record and categorize your expenditures. This practice allows you to compare actual spending against your budgeted amounts, identify discrepancies, and make necessary adjustments to stay on track.

Keep in mind that the 50/30/20 rule serves as a flexible guideline rather than a rigid mandate. Adjustments may be necessary based on your financial situation. For instance, if you find yourself managing significant debt, you might need to reallocate a larger portion of your income toward debt repayment, potentially reducing the amount set aside for discretionary spending. Tailoring the rule to fit your financial circumstances ensures that it remains practical and effective in helping you meet your financial goals.

Utilise applications and tools for budgeting to help you manage your money more efficiently. Tools such as Mint, YNAB (You Need A Budget), and PocketGuard offer valuable features for tracking expenses, setting budget limits, and monitoring financial progress. These apps provide insights and alerts that helps you stay within your budget and make more informed financial decisions. These tools will help you improve your financial management and make it easier to follow the 50/30/20 guidelines while creating your budget.

Typical Errors and How to Prevent Them

When implementing the 50/30/20 rule, one common mistake to avoid is misclassifying expenses. It’s crucial to accurately categorize your expenditures into needs, wants, and savings/debt repayment. Misclassification can disrupt your budget and lead to financial imbalances. For example, treating discretionary spending as essential expenses can skew your budget, making it difficult to maintain economic stability. To prevent this, carefully review each expense and ensure it fits into the correct category based on its necessity and purpose.

Overestimating income is another common mistake that can result in inflated expectations for budgeting. Always base your budget on your actual after-tax income rather than inflated estimates. Overestimating can result in setting unrealistic spending limits or savings goals, potentially leading to financial shortfalls. To avoid this, regularly update your budget to reflect your true income and make adjustments as needed to ensure that your financial plan aligns with your actual earnings.

Neglecting to build an emergency fund is a critical oversight that can jeopardize your financial stability. An emergency fund serves as a safety net for unforeseen costs, such as unplanned maintenance or medical problems. Prioritize allocating part of your savings towards building and maintaining this fund to ensure you’re prepared for unforeseen costs. By doing so, you can avoid financial stress and maintain a balanced budget even when unexpected expenses arise.

Benefits and Drawbacks of the 50/30/20 Rule

The 50/30/20 rule offers several advantages for budgeting. Its simplicity makes it easy to understand and implement, providing a clear framework for managing expenses and savings. The rule’s balanced approach ensures that you cover essential needs, allow for discretionary spending, and build savings, while maintaining a comprehensive view of your finances. Additionally, its flexibility allows for adjustments based on individual financial situations, making it adaptable to various income levels and personal goals.

However, the rule also has limitations. It may not suit everyone, particularly those facing high living costs or substantial debt, as the one-size-fits-all approach might not address specific financial challenges effectively. The rigid 50/30/20 split might also be less ideal for individuals with fluctuating incomes or unique financial objectives. For these reasons, while the rule provides a solid starting point, it may require customization to fit different economic circumstances and goals.

Conclusion

The 50/30/20 rule is a straightforward and practical budgeting method that allocates your income into three main categories: needs, wants, and savings/debt repayment. By dividing your finances this way, the rule helps ensure you cover essential expenses, enjoy discretionary spending, and contribute to savings or debt reduction. This balanced approach supports financial stability and provides a clear framework for managing your money effectively.

However, successful budgeting also requires consistency and adaptability. While the 50/30/20 rule is a valuable tool for many, it’s important to tailor your budget to reflect your financial situation and goals. Regularly reviewing and adjusting your budget will help you stay aligned with your objectives and navigate any changes in your financial circumstances, ultimately supporting your long-term financial well-being.